Introduction

The American Adjustment Bureau (AAB) is a specialized organization dedicated to assisting clients—usually insurance companies and corporations—navigate the complexities of insurance claims and adjustments. Established to enhance the efficiency and fairness of claim settlements, the AAB acts as an intermediary that ensures all parties involved are treated equitably and that claims are processed in accordance with the relevant laws and policies. By employing experienced adjusters and utilizing advanced technologies, the AAB plays a critical role in the insurance landscape, particularly in mitigating disputes and expediting resolutions. This article will delve into the workings, roles, and significance of the American Adjustment Bureau, providing comprehensive insights into its operations and impact on the industry.

What is the American Adjustment Bureau?

The American Adjustment Bureau is essentially a claims adjustment firm that operates within the insurance industry. Its primary goal is to facilitate the smooth processing of insurance claims, ensuring that both insurers and policyholders receive fair treatment. The AAB is instrumental in assessing damages, determining liability, and investigating claims discrepancies, among other responsibilities.

History and Background

The roots of the American Adjustment Bureau can be traced back to the evolving needs of the insurance market. Established in the early 20th century, it aimed to counteract inefficiencies and disputes inherent in the claims process. Through continual adaptation to regulatory changes and technological advancements, the AAB has become a trusted authority in claims adjustment. Over the years, the organization has expanded its services to cater to various sectors, including personal, commercial, and industrial insurance.

Core Functions of the American Adjustment Bureau

Understanding the core functions of the AAB is crucial to grasping its importance in the insurance industry. Some of these functions include:

- Claims Investigation: The AAB investigates claims to assess their validity. This often involves gathering evidence, interviewing witnesses, and reviewing documents related to the claim.

- Damage Assessment: Adjusters analyze property damage or injury claims to determine the appropriate compensation. They quantify losses and evaluate the repaired or replaced value of the damaged property.

- Negotiation: The AAB serves as a mediator between insurers and claimants, negotiating settlements that are fair to both parties. Their expertise often results in quicker resolutions.

- Fraud Prevention: By thoroughly investigating claims, the Bureau helps identify potential fraud, protecting the interests of legitimate policyholders and insurers alike.

The Role of Adjusters

Adjusters are the backbone of the American Adjustment Bureau. Trained professionals in the intricacies of insurance policies and claims handling, they investigate, negotiate, and resolve claims on behalf of the bureau. Their responsibilities encompass:

- Field Adjusters: These adjusters visit the scene of an incident to gather firsthand information. They are typically involved in property and casualty claims.

- Desk Adjusters: Working remotely, these adjusters evaluate claims based on submitted documentation and evidence, often handling cases that do not require physical inspections.

- Specialized Adjusters: Certain adjusters focus on niche markets, such as environmental claims or catastrophic events, requiring specialized knowledge and training.

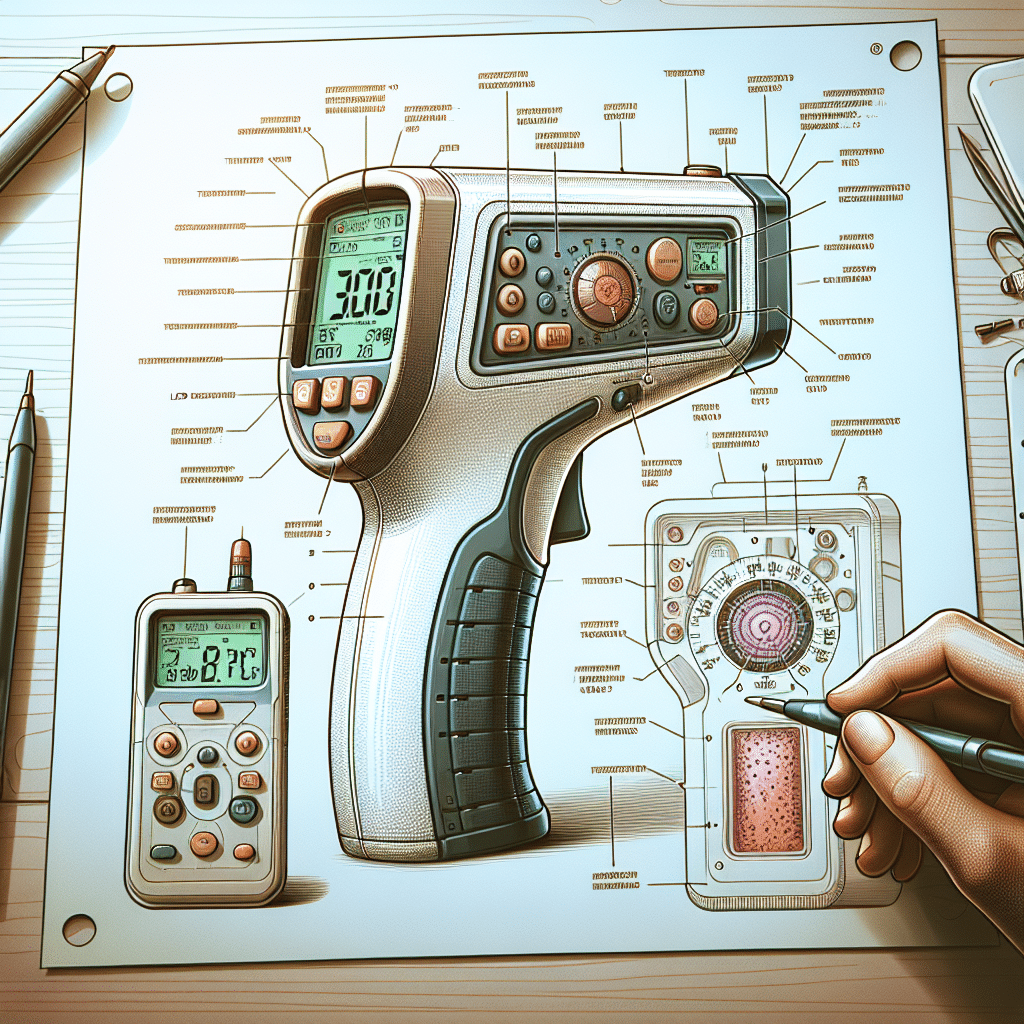

Technology in Claims Adjustment

In recent years, technology has significantly transformed the operations of the American Adjustment Bureau. The integration of tools such as drone technology, AI analytics, and digital documentation has streamlined the claims process, leading to faster and more accurate results. For instance, drones are now employed to survey large or hazardous areas, providing vital data for claims evaluation. Additionally, AI algorithms can quickly analyze vast datasets to uncover patterns or inconsistencies in claims, enabling faster decision-making.

Regulations and Compliance

The American Adjustment Bureau must adhere to various state and federal regulations that govern insurance practices. These regulations are designed to protect consumers and maintain the integrity of the industry. Complying with these laws ensures that the bureau operates within legal frameworks and mitigates the possibility of disputes arising from claims processing.

Benefits of Using the American Adjustment Bureau

Utilizing the services of the American Adjustment Bureau offers numerous benefits for both insurance companies and policyholders:

- Expertise: With a team of skilled professionals, the AAB brings extensive knowledge to claims adjustment, ensuring thorough evaluations and equitable settlements.

- Efficiency: The Bureau’s established processes and use of technology expedite claim resolution, minimizing the time policyholders must wait for settlements.

- Dispute Resolution: The AAB plays a pivotal role in mitigating disputes between claimants and insurers, helping to maintain good relationships within the industry.

- Consumer Protection: By focusing on fair treatment, the AAB helps protect consumers’ rights during the claims process, ensuring that they receive the compensation they are entitled to.

Challenges Faced by the American Adjustment Bureau

Despite its many benefits, the American Adjustment Bureau faces several challenges in the current insurance landscape:

- Fraud Detection: The increase in insurance fraud continues to place pressure on the Bureau to improve its investigation methods and technologies.

- Regulatory Changes: Keeping up with dynamic regulatory environments can be complex. The Bureau must constantly adapt to ensure compliance.

- Technological Advances: As technology evolves, the AAB must invest in training and tools to remain competitive, which can be resource-intensive.

Frequently Asked Questions (FAQs)

What services does the American Adjustment Bureau provide?

The American Adjustment Bureau primarily provides claims investigation, damage assessment, negotiation services, and fraud prevention for insurance claims.

How does the AAB ensure fair treatment for policyholders?

The AAB employs experienced adjusters who adhere to industry regulations and best practices to ensure that claims are evaluated fairly and equitably.

Can I trust the American Adjustment Bureau with my claim?

Yes, the AAB has built a reputation for reliability and professionalism. They are committed to protecting the interests of both insurers and policyholders.

How does technology impact the claims adjustment process?

Technology enhances the efficiency and accuracy of the claims adjustment process, allowing for quicker evaluations and more precise damage assessments through tools like drones and AI analytics.

Conclusion

The American Adjustment Bureau is a crucial player in the realm of insurance claims adjustment, ensuring that claims are handled in a just and efficient manner. By leveraging technology and the expertise of seasoned professionals, the AAB continues to set the standard for excellence in the industry. As the landscape of insurance evolves, the American Adjustment Bureau remains committed to adapting and enhancing its services to meet the changing needs of its clients, thereby reinforcing its position as a trusted ally within the insurance community.