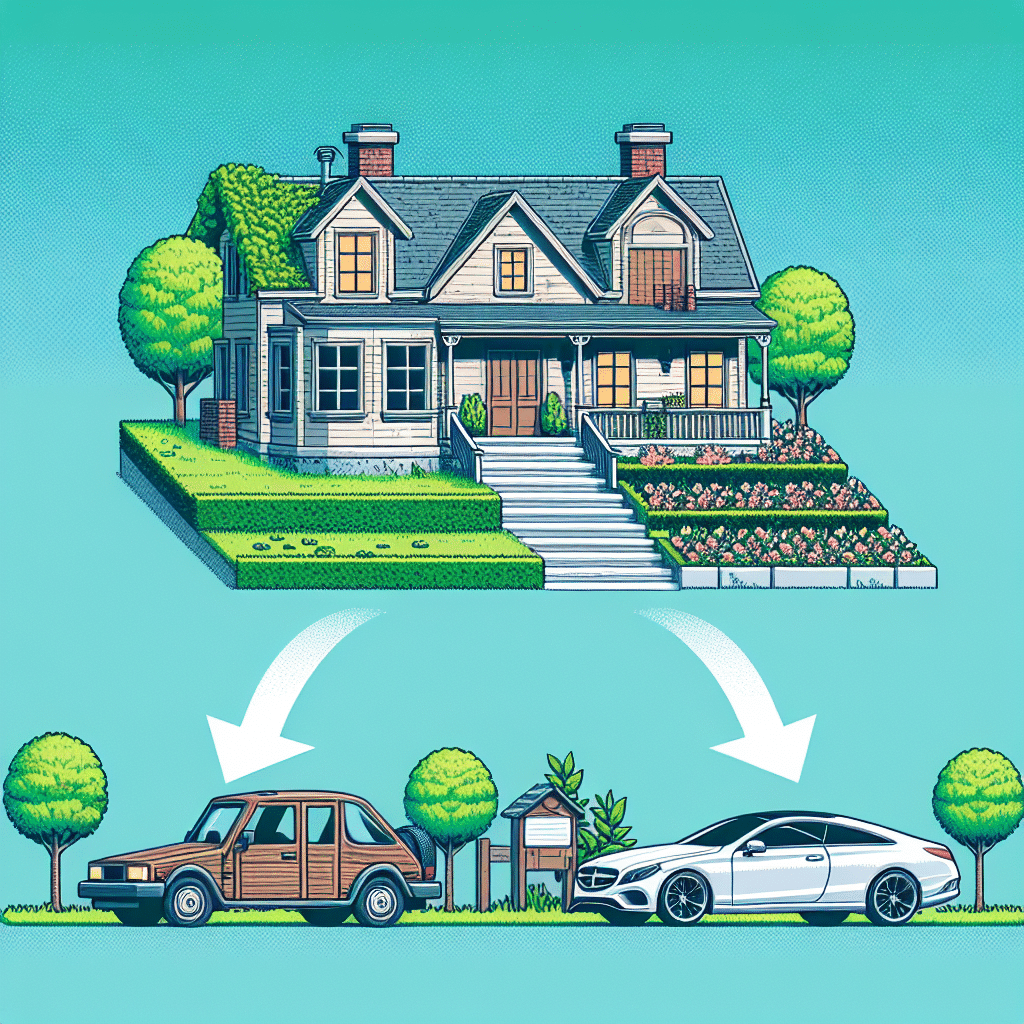

Going to a different income refers to the transition from one financial bracket to another, often signaling changes in your earning potential, employment status, or overall financial situation. This shift can occur due to various factors such as career advancement, switching jobs, pursuing higher education, or entering entrepreneurship. Understanding what it means to change your income level is crucial, as it can impact your lifestyle, budgeting, and financial goals. Whether you’re moving from a lower-income to a middle-income bracket or experiencing a raise within your current job, recognizing the implications of this transition is essential for effective financial planning and future success.

Understanding Income Levels

Income levels are critical for categorizing an individual’s or household’s financial capacity. The U.S. government classifies income levels into several brackets, such as low, moderate, middle, and high income. These classifications help in defining eligibility for financial aid, housing, and social services. Understanding these ranges can aid you in benchmarking your financial situation and setting realistic financial goals.

Income Brackets Explained

- Low Income: Households earning below 80% of the median income for their area.

- Middle Income: Households earning between 80% and 120% of the median income.

- High Income: Households earning above 120% of the median.

For example, the median household income in the United States is approximately $70,000 annually. Therefore, low-income households earn less than $56,000, while high-income households earn more than $84,000.

Reasons for Transitioning to a Different Income

The decision or necessity to transition to a different income level can arise from various motivations and circumstances:

Career Advancement

Career advancement is among the most common reasons for a shift in income levels. Accepting a promotion, moving to a higher-paying position, or taking on greater responsibilities often leads to increased earnings. For instance, someone working as a sales associate may advance to sales manager, reflecting an increase in both duties and salary.

Job Change

Switching jobs can also result in income changes. Many individuals pursue new opportunities that offer better benefits or salary packages. According to a LinkedIn report, employees who change jobs often see a 10% to 20% increase in salary compared to staying in the same position.

Further Education

Pursuing further education or obtaining professional certifications can enhance your skill set, often leading to higher-paying job opportunities. Graduates with advanced degrees, for instance, typically enjoy a salary premium over their peers with only a bachelor’s degree.

Entrepreneurship

Transitioning from traditional employment to entrepreneurship presents significant risks and potential rewards. Starting a business can initially lead to lower income but may eventually result in substantial financial gain if the venture succeeds.

Financial Implications of Changing Income Levels

Shifting income levels carries several financial implications that you must consider:

Budgeting and Financial Planning

A change in income directly impacts your budgeting. Increased income may allow for more savings, investments, and lifestyle upgrades like better housing or travel. Conversely, decreases may force you to reassess your financial priorities and cut back on non-essential spending.

Tax Considerations

Your tax bracket can change with a transition in income. Higher earners may face increased tax rates and should consider consulting a tax professional for strategic planning to minimize liabilities.

Impact on Lifestyle

Changes in income levels can significantly affect your lifestyle and spending habits. An increase might afford you luxuries previously out of reach, whereas a decrease may require adopting a more frugal lifestyle.

FAQs

What does it mean to increase my income?

Increasing your income typically means earning more money through various means such as promotions, job changes, or additional income streams like side gigs or investments.

What are the typical ways to change my income level?

Common methods include seeking promotions, changing jobs, pursuing further education or certifications, or starting a business.

How can I manage my finances effectively after a change in income?

To manage your finances effectively, reevaluate your budget, adjust your spending habits, and consider setting new financial goals based on your new income level.

Is it possible to decrease my income intentionally?

Yes, some individuals may choose to decrease their income, for instance, to pursue lower-paying jobs that provide better work-life balance or to focus on personal projects or caregiving responsibilities.

Strategies for Navigating Income Changes

Successfully navigating changes in income levels involves strategic planning:

Financial Literacy

Improving your understanding of finances, including budgeting, saving, and investment, will strengthen your ability to adapt to new income levels. Numerous resources, such as online courses and personal finance books, can be beneficial.

Emergency Fund

Establishing an emergency fund is essential, especially if transitioning to a lower income. This fund can help cover unexpected expenses and provide a financial cushion during times of uncertainty.

Professional Guidance

Consider seeking advice from financial advisors or career coaches to refine your approach to managing transitions in income effectively. They can provide personalized strategies suited to your particular circumstances.

Regular Financial Reviews

Conduct regular reviews of your financial situation to understand the impact of your income change and adjust your budget, savings, and plans as necessary.

Conclusion

Transitioning to a different income level can be a pivotal moment in your financial journey, offering both challenges and opportunities. Understanding the implications of such changes, leveraging strategies for adjustment, and maintaining financial literacy will empower you on this journey. Embrace the change with confidence and a proactive mindset, and you will be well-positioned to achieve your financial goals.