Introduction

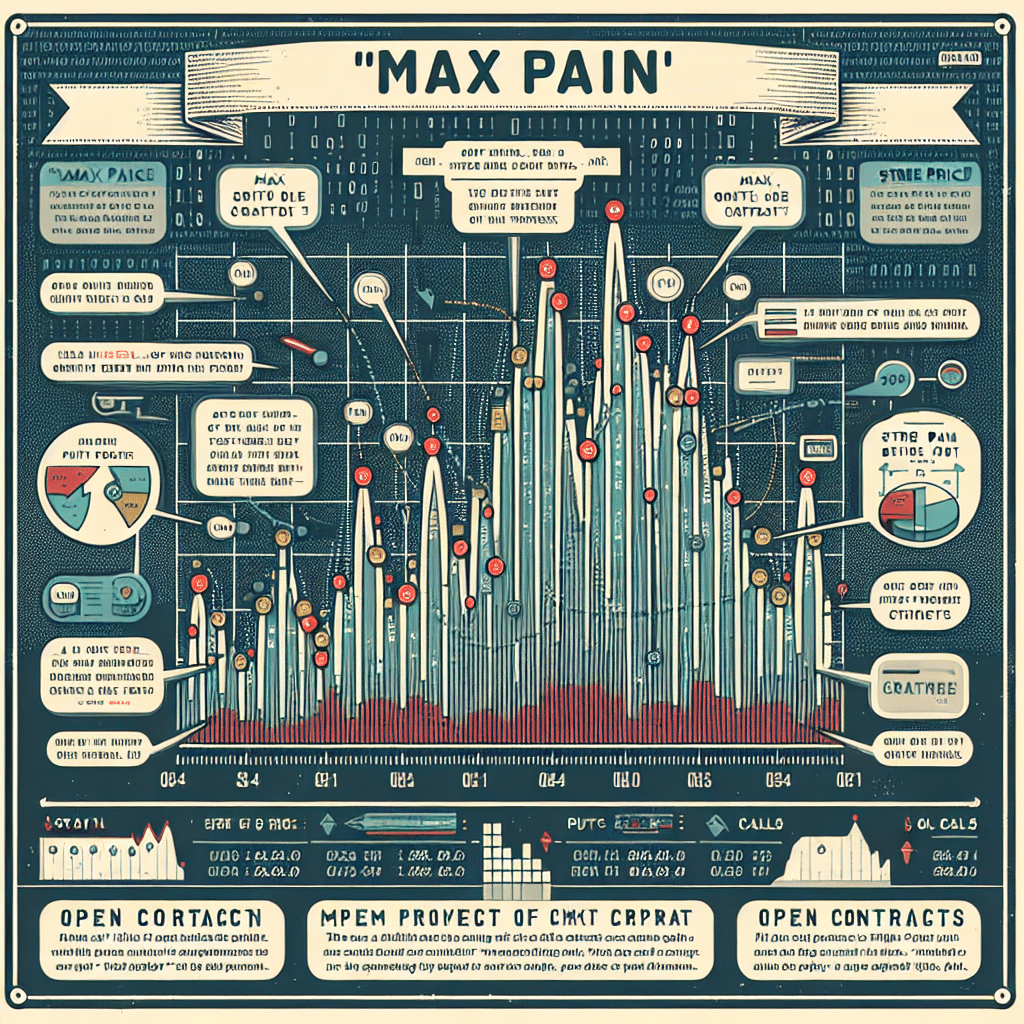

Max pain in the context of options trading refers to a critical concept leveraged by traders to predict price movements of an underlying asset as expiration dates approach. Specifically, in the Sensibull screener, max pain represents the price point at which the maximum number of options—both calls and puts—expire worthless. This value suggests a level where the options market exhibits the greatest “pain” for option holders, thus helping traders ascertain potential price trajectories for underlying stocks or indices. Understanding this metric is vital for options traders as it can enhance decision-making processes and profit optimization strategies.

Understanding Max Pain

Max pain theory operates on the principle that stock prices tend to gravitate towards a level that maximizes the losses for options holders at expiration. It provides insights into the behavior of market participants, essentially inferring that the price at which options holders incur the most losses (‘max pain’) could likely influence market movements leading up to expiration. Therefore, traders can utilize this information to make informed trading decisions.

How Max Pain is Calculated

The calculation of max pain involves aggregating the total open interest of all call and put options at various price levels for the asset in question. The procedure entails the following steps:

- Open Interest Analysis: Gather data on the open interest for all call and put options at various strike prices.

- Loss Calculation: For each price point (strike price), calculate the total dollar amount that would be lost by both call and put option holders if the stock closes at that price on expiration.

- Max Pain Identification: Identify the strike price where the total losses are maximum; this price point becomes the theoretical max pain level.

Significance of Max Pain in Trading

The significance of max pain in options trading is evident in its potential to naturally influence buying and selling behaviors:

- Market Sentiment: Max pain illustrates where the market sentiment may push the price as expiration approaches. It serves as a self-fulfilling prophecy as traders may align their strategies towards the max pain point.

- Volatility Indications: High volumes of open interest near the max pain point can also serve as indicators of increased volatility as traders line up their positions for expiration.

- Risk Management: Knowing the max pain level can also aid in setting strategies for risk management, such as hedging against potential adverse price movements.

Max Pain in the Sensibull Screener

Sensibull, a prominent trading platform, offers a user-friendly interface for options traders, providing comprehensive insights, including the max pain metric. By visualizing max pain, traders can track potential price movements and adapt their strategies accordingly. The Sensibull screener also highlights various other relevant data points, allowing traders to combine max pain insights with broader market analysis.

The Practical Use of Max Pain

In practical trading scenarios, understanding max pain can equip traders with the following advantages:

- Strategic Positioning: Traders can plan their entry and exit strategies based on projected movements towards the max pain level.

- Informed Decisions: Having knowledge about max pain helps traders reinforce their decisions with actionable data, reducing emotional trading.

- Profit Maximization: By capturing price movements that align with the max pain point, traders can enhance potential returns significantly.

Counterarguments and Limitations

While the max pain theory offers insightful guidance, it is essential to recognize its limitations:

- Market Dynamics: Variables such as unexpected earnings reports, macroeconomic changes, or sudden market news can override the predictions made by max pain.

- Statistical Relevance: Not all market movements adhere to max pain principles, and hence reliance solely on this metric might result in misleading conclusions.

FAQ Section

What is max pain in options trading?

Max pain refers to the price point where the maximum number of options—calls and puts—expire worthless, inflicting losses on option holders.

How does max pain influence stock prices?

Max pain influences stock prices as it often serves as a magnet for price movement, with many traders aligning their strategies around this figure, leading to a potential self-fulfilling prophecy.

What tools can I use to calculate max pain?

Various trading platforms, including Sensibull, provide tools and calculators to help traders determine max pain levels based on the open interest of options.

Can max pain be relied upon for trading decisions?

While max pain can offer valuable insights, it should be combined with other market analysis tools and knowledge to inform trading decisions accurately.

How often should I check max pain levels?

It is advisable to check max pain levels regularly, especially as expiration dates approach, to understand potential price movements and adjust trading strategies accordingly.

Conclusion

Max pain is a significant concept within options trading, offering valuable insights into how stock prices may behave near expiration dates. Utilizing this knowledge effectively, particularly through platforms like Sensibull, provides traders with an edge in the competitive markets. However, it is crucial to remain aware of the limitations of this metric and to incorporate it into a broader trading strategy that considers multiple factors influencing market dynamics.