A central differential refers to a specific financial mechanism or concept widely utilized in various industries, particularly in finance and economics. It represents the difference between two central values or averages, typically in relation to market rates or benchmarks. This term can also signify the variation in performance metrics or rates in certain financial instruments. Understanding central differentials is crucial for investors and analysts to gauge market trends, assess financial health, and make informed decisions. By closely analyzing these differentials, stakeholders can unveil underlying patterns, adjust strategies, and enhance risk management practices. In essence, the central differential serves as a vital indicator in navigating the complex landscape of financial markets, enabling participants to identify opportunities and potential pitfalls.

Understanding Central Differentials

In the context of finance, the term ‘central differential’ encompasses several dimensions that impact investment decisions, economic evaluations, and market behavior. This section delves into the definitions, applications, and relevance of central differentials in contemporary finance.

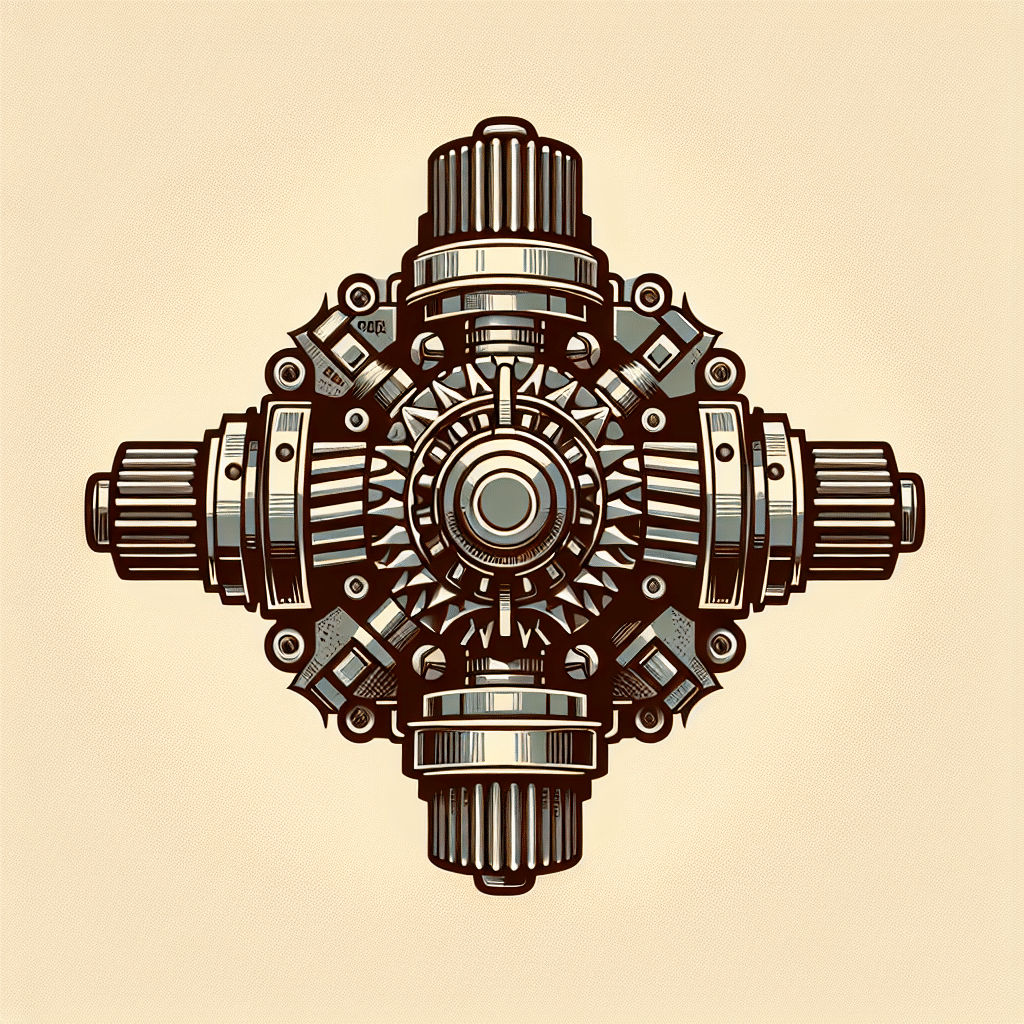

Definition of Central Differential

A central differential typically denotes the difference between a central tendency measure—such as means, medians, or modes—and another benchmark rate, be it an interest rate or an economic indicator. It encapsulates variations which can reflect shifts in market dynamics and economic factors. For instance, understanding the central differential between long-term and short-term interest rates can help financial analysts anticipate economic growth or recession patterns.

Types of Central Differentials

Central differentials can manifest in multiple forms, including:

- Interest Rate Differentials: These depict the difference between interest rates in different currencies or among different financial products, influencing exchange rates and investment flows.

- Market Performance Differentials: This involves the comparative performance metrics of various financial instruments. For example, the central differential can indicate the relative performance of stocks in a specific sector.

- Risk Assessment Differentials: Evaluating differences in credit risks among various investment avenues is crucial for informed decision-making.

Applications of Central Differentials

Central differentials play a pivotal role in several applications:

- Investment Strategies: Investors utilize central differentials to identify underperforming assets, thus helping to optimize their portfolios.

- Monetary Policy: Central banks observe interest rate differentials to form monetary policy, aiming to stimulate or control inflation and economic growth.

- Risk Management: Financial institutions monitor differentials to gauge risk exposure, making necessary adjustments to mitigate potential losses.

Calculating Central Differentials

The calculation of central differentials can vary depending on the context and the data involved. The following subsections outline some typical calculations:

1. Interest Rate Differential Calculation

To calculate the interest rate differential between two currencies (e.g., the U.S. dollar and the European Euro), one uses the following formula:

Interest Rate Differential = Interest Rate of Currency A – Interest Rate of Currency B

For example, if the interest rate in the U.S. is 2% and in the Eurozone is 1%, the interest rate differential is 1%.

2. Performance Differential Calculation

Calculating performance differentials between two stocks can involve the following formula:

Performance Differential = Return of Stock A – Return of Stock B

If Stock A yields a 10% return and Stock B yields a 7% return, the performance differential is 3%.

3. Risk Differential Calculation

To assess risk differentials among various financial instruments, you might consider:

Risk Differential = Risk Assessment of Investment A – Risk Assessment of Investment B

If Investment A has a risk score of 5 and Investment B has a score of 3, the risk differential is 2.

Central Differentials in the Current Economic Context

As of 2023, the landscape of central differentials continues to evolve, driven by factors such as global economic conditions, interest rate trends, and technological advancements in trading platforms. With the Federal Reserve’s monetary policies impacting interest rates significantly, understanding these differentials has become increasingly vital for investors and institutions alike.

Recent Trends in Interest Rates

Recently, there has been a notable upward trend in interest rates, leading to widened interest rate differentials in many economies. This trend has implications for foreign exchange markets, affecting currency valuations and international trade flows.

Impact on Investment Decisions

The current economic climate has pushed investors to rethink their strategies by closely examining central differentials. Many are shifting towards fixed-income securities or capitalizing on assets that offer better yields, responding to the widening rate differentials.

Addressing Counterarguments

While an understanding of central differentials is essential, some argue that reliance on these metrics can lead to short-sighted investment decisions. For instance, fluctuations in differentials may sometimes provide misleading signals about market health. It is crucial to consider these metrics in conjunction with other fundamental and technical analyses to form a holistic view.

Conclusion

The concept of central differentials encapsulates a critical component of financial analysis and decision-making. By recognizing and analyzing these differentials, investors can enhance their understanding of market dynamics, identify opportunities, and implement effective risk management strategies. In a landscape that is constantly changing, the importance of staying informed about central differentials remains paramount.

Frequently Asked Questions (FAQ)

What are central differentials?

Central differentials refer to the differences between central values such as interest rates, performance metrics, or other economic indicators, typically used to assess financial health and market trends.

How are central differentials calculated?

Central differentials can be calculated by subtracting one central tendency measure from another, for example, by finding the difference between interest rates of two currencies or performance metrics of two stocks.

Why are central differentials important?

Central differentials are important because they provide insights into market behavior, facilitate informed investment decisions, and help in risk management by highlighting variations that can affect asset performance.

Can central differentials be misleading?

Yes, central differentials can sometimes provide misleading signals. It is crucial to consider them alongside other metrics and analyses to obtain a comprehensive understanding of financial markets.