Risky valuation ratings for stock typically indicate that a company’s stock is overvalued or underperforming relative to its earnings potential, future growth prospects, and market conditions. A stock may receive a risky valuation rating based on several factors, including high price-to-earnings (P/E) ratios, substantial debt levels, or unsustainable growth projections. Investors should be cautious of such ratings as they often signal potential price corrections or increased volatility. A careful analysis, considering both qualitative and quantitative metrics, is essential in evaluating whether to proceed with investments tied to such ratings to mitigate potential financial losses.

Understanding Risky Valuation Ratings

When evaluating stocks, investors rely heavily on valuation ratings to gauge whether a stock is potentially a good investment opportunity or not. Risky valuation ratings serve as a cautionary signal, telling investors that the perceived valuation of a stock comes with elevated risks. Understanding these ratings is crucial for responsible investing.

What Constitutes a Risky Valuation Rating?

A stock can be deemed as having a risky valuation rating due to several characteristics:

- High Price-to-Earnings Ratio: A high P/E ratio indicates that a stock is trading at a premium compared to its earnings. This often suggests overvaluation and expectations for future growth that may not materialize.

- Weak Fundamentals: Companies exhibiting poor revenue growth, low profit margins, or negative earnings can have risky valuations. Investors should scrutinize financial statements for signs of deterioration.

- High Debt Levels: Stocks with high debt-to-equity ratios can be classified as risky, particularly in economic downturns, as they may struggle to cover their financial obligations.

- Market Sentiments: Stocks that are heavily influenced by market sentiments rather than fundamental valuations may often see inflated prices, leading to risky valuations.

Evaluating Risky Valuations

To make informed investment decisions, you should closely analyze the components of a stock’s valuation:

- Comparative Analysis: Compare the stock’s ratios with industry peers to assess if the valuation is excessive. Industry norms provide a useful benchmark.

- Future Earnings Projections: Engage in forecasting future earnings using established models such as discounted cash flow analysis to determine intrinsic value.

- Assess Risk Management: Evaluate how a company is managing its risks, particularly in volatile sectors. Developing an understanding of risk can help in deciding whether a risky valuation rating is warranted.

Common Metrics Indicating Risky Valuations

Several metrics can indicate whether a stock might have a risky valuation rating. Here are a few significant ones you should consider:

Price-to-Earnings (P/E) Ratio

The P/E ratio helps investors assess a company’s current share price relative to its earnings per share (EPS). A significantly higher P/E ratio compared to industry peers can signal overvaluation, raising the risk of a price correction.

Price-to-Book (P/B) Ratio

The P/B ratio gauges a company’s market value relative to its book value. A high P/B ratio can indicate inflated stock prices, particularly if the underlying earnings do not support such pricing.

Debt-to-Equity (D/E) Ratio

A high D/E ratio suggests that a company is heavily financed through debt. In uncertain economic times, such companies are at a greater risk of experiencing financial distress, translating to risky valuations.

Dividend Yield

Lower dividend yields might indicate a company is reinvesting earnings into growth ventures rather than returning value to shareholders. If the company fails to grow as projected, it may lead to downward adjustments in the stock price.

Real-World Examples

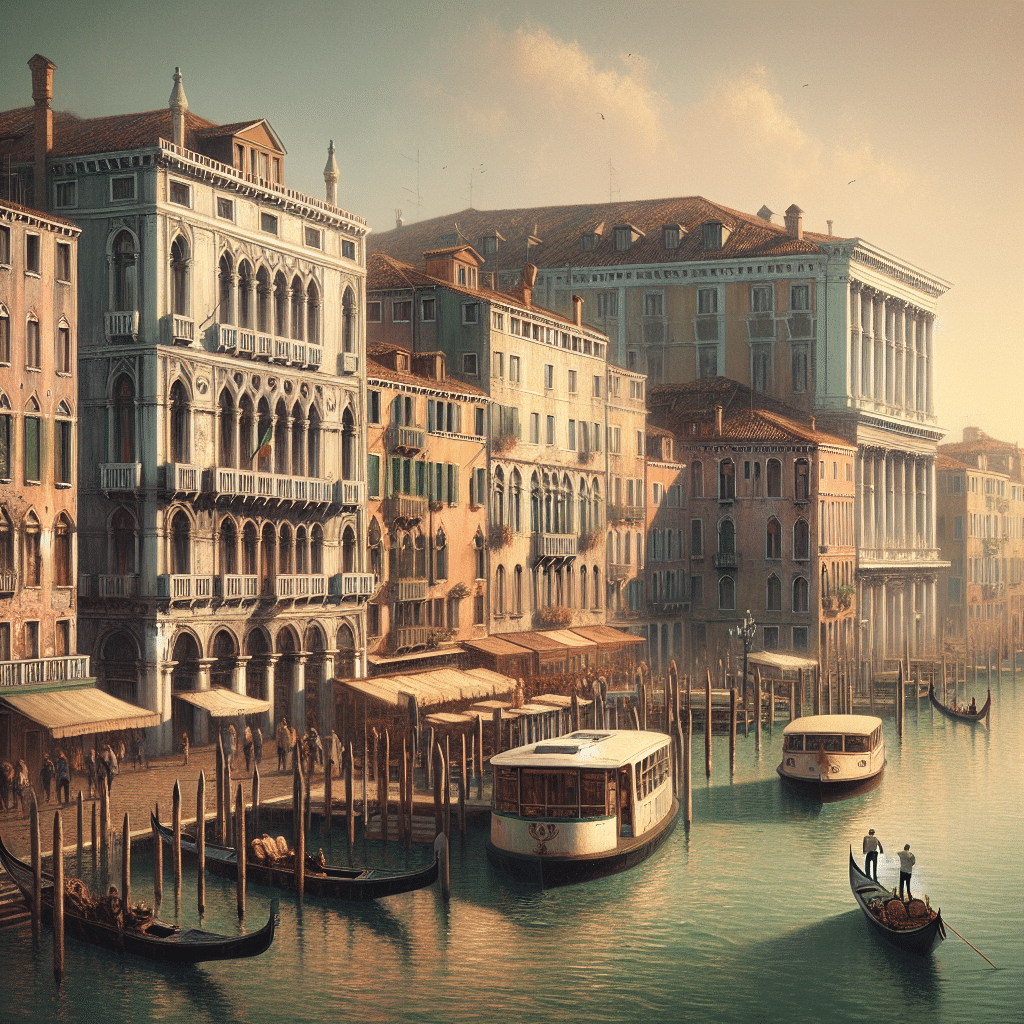

To illustrate how risky valuation ratings manifest in the real world, consider the case of certain technology stocks that entered the market during the dot-com bubble. Many companies showed exceptional growth projections despite limited revenue—resulting in exorbitant valuations that could not be sustained. The subsequent market correction serves as a cautionary tale for investors who failed to take heed of these risky valuations.

Strategies to Mitigate Risk

While risky valuation ratings can be daunting, adopting specific strategies can help mitigate potential negative impacts:

Diversification of Portfolio

By spreading investments across various asset classes, you reduce your dependency on any single stock’s performance, diminishing the impact of risky valuations.

Thorough Research

Conducting comprehensive analyses—not only on the quantitative metrics but also on qualitative aspects, such as management competence, industry changes, and economic conditions—can provide a balanced overview of potential risks.

Setting Investment Limits

Determining a clear exit strategy and monitoring investment performance diligently will help exit positions before facing significant losses.

Frequently Asked Questions (FAQ)

What is the difference between valuation ratios and risky valuation ratings?

Valuation ratios such as P/E, P/B, and D/E provide quantitative measures of a stock’s value. In contrast, a risky valuation rating incorporates these ratios and qualitative factors to indicate potential investment risks.

How can I identify risky valuation ratings effectively?

Careful scrutiny of financial metrics in tandem with news, market trends, and comparative analysis can help you recognize risky valuation ratings. It’s important to look beyond the numbers and analyze market sentiment as well.

Are risky valuation ratings always indicative of future losses?

Not necessarily. A risky valuation rating is a warning. While it may suggest higher volatility or potential price corrections, the stock may still deliver positive returns if the underlying fundamentals improve. Careful monitoring and analysis remain essential.

What industries are more prone to risky valuations?

Technology, biotech, and emerging markets often exhibit higher aggressive growth expectations, making their stocks prone to risky valuations. Investors should exercise caution when diving into these sectors.

Conclusion

In conclusion, understanding what constitutes a risky valuation rating is vital for navigating the complexities of stock investing. Recognizing the indicators, performing thorough research, and employing risk mitigation strategies can empower you to make informed decisions that align with your investment goals. Remember, while risky ratings might suggest caution, they do not preclude identifying opportunities to capitalize on undervalued stocks in a discerning market.