Property tax in East Carbon, Utah, in 2023 is a crucial aspect of local government funding and community services. It is levied on real estate properties based on their assessed value, which is determined by the local county assessor. In East Carbon, the property tax rate can vary, but it typically falls within the range of 1% to 1.5% of the assessed property value. This tax revenue is primarily used to support public schools, infrastructure, law enforcement, and other essential municipal services.

The assessment process involves a periodic evaluation of property values to ensure accurate taxation, and property owners have the right to appeal their assessment if they believe it is too high. Understanding property tax liabilities is important for current and prospective homeowners, as fluctuations can affect annual budgets and real estate investment decisions. As you explore your options in East Carbon, staying informed about property tax rates and regulations will empower you to make prudent financial decisions.

Understanding Property Tax in East Carbon, Utah

Property tax is a key funding source for local governments in the United States, and East Carbon, Utah, is no exception. In this section, we’ll delve deeper into how property tax operates in East Carbon, detailing its calculations, impact on residents, and essential regulations to be aware of in 2023.

What is Property Tax?

Property tax is an ad valorem tax based on the value of real estate properties. Local governments assess these properties, and tax rates are applied to the assessed value to determine the total tax due. In East Carbon, property taxes primarily fund crucial services, including:

- Public schools

- Infrastructure maintenance, such as roads and bridges

- Public safety, including police and fire services

- Parks and recreational facilities

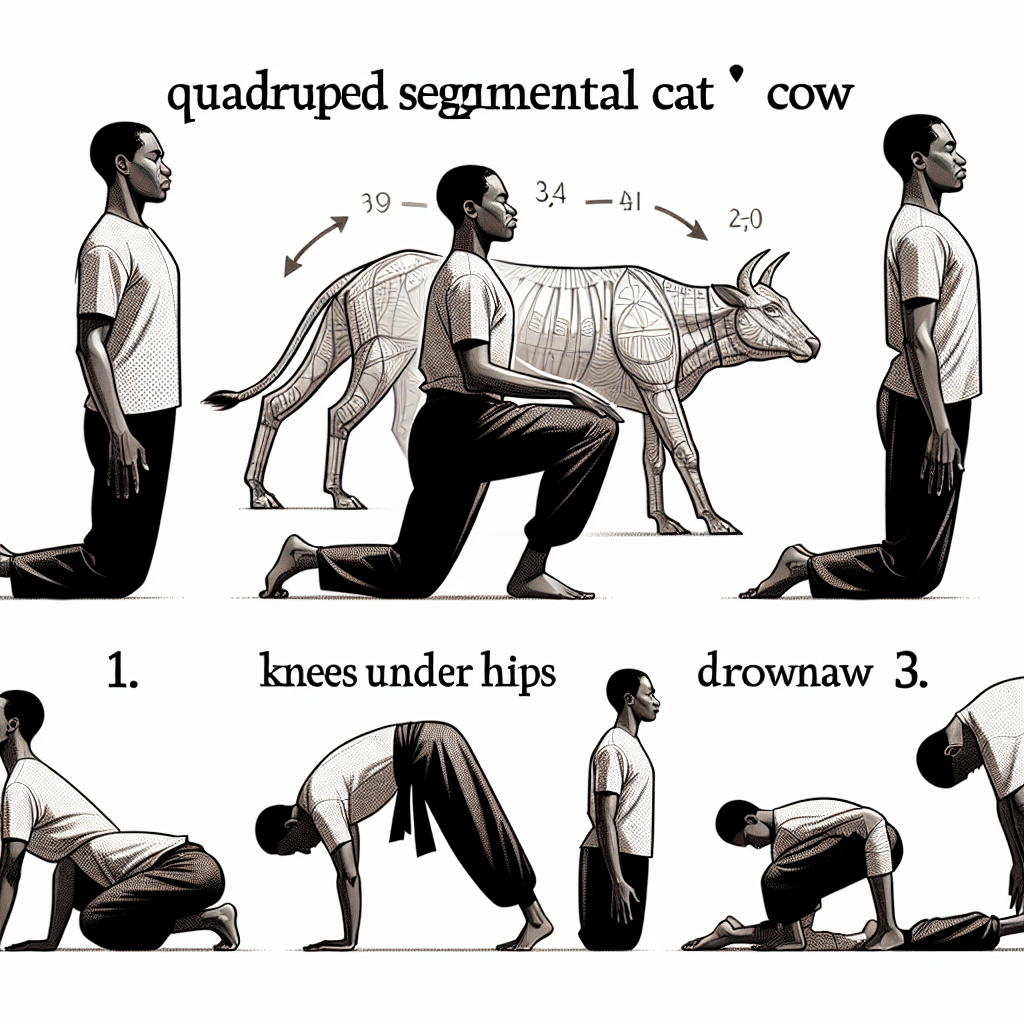

How is Property Tax Calculated?

The process of calculating property tax in East Carbon involves a couple of steps:

- Assessment: The county assessor evaluates properties at least once every five years. This assessment considers factors like property size, location, and improvements.

- Tax Rate Application: Once assessed, the property value is multiplied by the local tax rate, typically expressed in mills (dollars per $1,000 of assessed value). For instance, if the assessed value is $100,000 and the tax rate is 1.25%, the annual property tax would be $1,250.

Property Tax Rates in East Carbon

In 2023, the property tax rate in East Carbon can vary, but it tends to range from 1% to 1.5%. It’s important to consult the Carbon County Assessor’s Office for the most accurate and up-to-date information regarding specific rates, as these can change based on budgetary needs and local tax policies.

Impact of Property Taxes on Residents

The amount paid in property taxes can significantly affect the residents of East Carbon. Higher property taxes can lead to increased living costs, influencing housing affordability. Conversely, lower taxes can encourage growth and attract new residents. It’s crucial for homeowners to understand how these taxes fund community services, thereby contributing to the overall quality of life in East Carbon.

Property Tax Exemptions

In some cases, property owners in East Carbon may qualify for tax exemptions or reductions. These can include:

- Homestead Exemption: Typically available for primary residences, providing a reduction in property tax rates.

- Veteran Exemptions: Offered to qualifying veterans and their families.

- Senior Citizen Exemptions: Available for seniors who meet specific income levels.

Consulting with local tax offices can provide homeowners with information on how to apply for these exemptions.

Appealing Your Property Tax Assessment

If you believe your property has been overvalued, East Carbon residents have the right to appeal their property tax assessment. The appeal process involves several steps:

- Gathering evidence, such as recent sales data of similar properties.

- Submitting a formal appeal with the Carbon County Board of Equalization.

- Participating in a hearing where you can present your case.

Understanding this process is vital, as successfully appealing can lead to significant tax savings.

Frequently Asked Questions (FAQ)

1. What is the average property tax rate in East Carbon, Utah?

The average property tax rate in East Carbon typically ranges from 1% to 1.5%, depending on the assessed value of the property and specific local requirements.

2. How is property value assessed in East Carbon?

Property assessments in East Carbon are conducted by the county assessor every five years. The assessment considers property size, improvements, and comparable sales in the area.

3. Can I appeal my property tax assessment?

Yes, homeowners in East Carbon can appeal their assessments if they believe them to be incorrect. This involves submitting evidence and participating in a hearing with the local tax board.

4. Are there exemptions available for property taxes in East Carbon?

Yes, exemptions such as the homestead exemption, veterans’ exemption, and senior citizen exemptions may be available to qualifying property owners in East Carbon.

5. Where can I find more information on property taxes in East Carbon?

For more details, you can visit the Carbon County Assessor’s Office website or contact them directly for inquiries related to property taxes, assessments, and exemptions.

Conclusion

Navigating property tax in East Carbon, Utah, in 2023 requires a clear understanding of how assessments work, the rates applied, and the impact these taxes have on residents. Being well-informed is essential for property owners to ensure they are paying fair taxes while maximizing potential savings through exemptions or appeals. For specific inquiries or additional details, reach out to local tax authorities.